Hitting the Ground Running

We had to learn very quickly, about the practicalities of living abroad, because from Day 1, we were having to deal with real things. Things, which in your home country are easy to understand because you know what to do, where to go and can understand the language and communicate.

On our first day in the house, we realised that pretty soon, we would need to open a bank account, buy a car, get the utilities into our names, insure the house, get the Internet connected, buy furniture, locate our nearest supermarket, buy DIY materials. You get the picture. We were effectively starting again, but with absolutely no idea where to start. So, we hope that in eventually compiling this “How To…” guide, we can give you some direction, if you are embarking on a similar journey.

Get Yourself an OIB

You will need an OIB (Osobni Identifikacijski Broj) in order to do almost everything financial in Croatia. It is similar to the UK National Insurance number or your particular country’s identification number, and you will need to have this unique reference number in order to buy a property, open a bank account, have a mobile phone contract, have utilities accounts in your name, purchase a car, and, most importantly, if you are planning to apply for residency.

It’s an easy procedure – all you need to do is visit a Ministry of Finance (or Ministarstvo Financija) tax office, with your passport and complete a simple form. There is no cost to obtaining your OIB. If the office is not too busy, you will be issued there and then with your OIB – keep a record of the number, because in the early days especially, you will need to provide this over and over again.

Purchasing a House

From our personal experience, purchasing a house in Croatia – or more specifically, Istria – is a relatively simple process. However, this is based on our experience alone and we can only offer advice relating to our particular set of experiences. As with property purchases anywhere, we would strongly recommend that you take legal advice and ensure that all of the necessary checks are done.

We bought our property via a private sale, pre-Brexit*, after finding the house on the Right Move Overseas website. We travelled out to Istria to view the property and all negotiations were done initially between ourselves and the vendors. In our particular set of circumstances, this was made easier because the sellers (English and Croatian, so no language difficulties) lived in the UK and we actually met up to discuss the purchase. We were provided with many documents relating to the structural work which had been carried out on the house, and so although no survey was carried out on the property (very rare in Croatia), we had the reassurance of official documents – and we also met the builder who had done the works, when we actually stayed at the house, pre-purchase, with the people who were selling (these documents will be available for inspection). Our offer price was accepted and a deposit (agreed between us and the vendors) was paid, to ensure that the property was no longer marketed. We travelled back to Istria to complete the purchase. The vendors (who by this time, we knew well and trusted – very important), suggested a firm of solicitors who they had used previously, and also arranged for an interpreter to be present to translate all documents and to ensure that we were very clear about the process.

We were paying for the property in cash, having sold our house in the UK. It is worth noting, that we did not have a Croatian bank account at the time, so monies were transferred from our UK account. However, and this is something to be aware of, as many vendors will not be as accommodating as ours were – we had to pay the balance in three tranches over three days, because there was a limit on how much we could transact in one day. The first tranche was paid in the solicitors’ office, with a written guarantee that the next two tranches would be paid over the next two days. The written guarantee – drawn up by the solicitor and signed by all parties – meant that the vendors felt comfortable handing over the keys and all additional paperwork which did not need to be lodged with the solicitor. We therefore understand the need to be flexible.

We are aware that our circumstances were very unusual, and most people buying abroad will probably do so through a real estate agent, but our story does show that where there’s a will, there’s very definitely a way!

*Residency can still be acquired for UK nationals, but we would suggest you do your own research. For serious purchasers, we can always advise and give you access to our excellent solicitor.

Fees

We strongly recommend that anyone considering purchasing a property abroad, thoroughly investigates all fees. The figures quoted below may have been changed and do not represent the definitive list of fees. These are illustrative only.

Solicitors’ Fees: These vary, but on average they are 1.5% (of the purchase price) + VAT which is in accordance with the regulations set out by the Ministry of Justice.

Croatian Real Estate Transfer Tax (RETT) & VAT: Similar to stamp duty, RETT is 3% and paid by every buyer. The tax application is sent by the solicitor, to the purchaser, within 30 days from the date of signing the contract and must be paid within 15 days from receiving the resolution from the Tax office. Any outstanding payments to the tax office incur 17% interest until settlement. Croatian properties built after 1 January 1998 are subject to 25% VAT which is calculated on the costs of the built portion of the property and is usually absorbed by the seller into the price. (VAT can be refunded if the buyer is purchasing with an entity that is within the VAT system and the property is being used for commercial purposes).

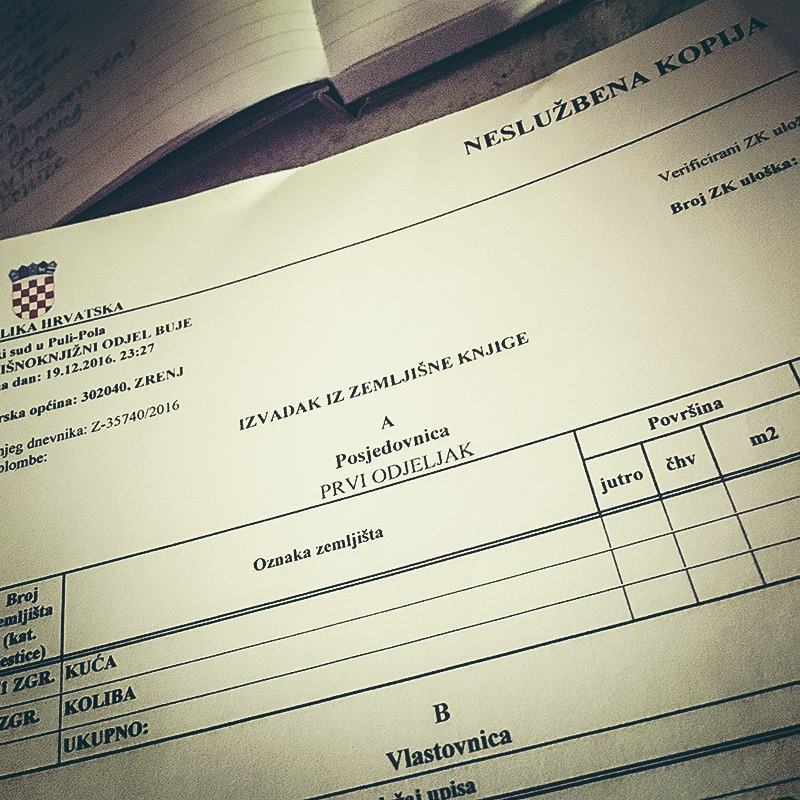

The Importance of “Clean Title”

This is the very first thing you need to establish if you are going to purchase a property in Croatia. Or, anywhere for that matter – although how to do this will vary from country to country. In Croatia, this is why it is so, so crucial.

Over the past 100 years, Croatia has undergone many, many changes. Since the Austro-Hungarians went back home, it has experienced the two world wars, a communist regime under Tito and the devastating regional war of the 1990s, subsequently emerging as an independent and rapidly developing European country and a part of the EU. Unsurprisingly, these changes have brought with them a whole host of problems relating to land and property ownership. Some properties were confiscated by the communists, with many original owners now wanting them back. Very often transfer of ownership of properties was not registered, usually to avoid taxes. And, the biggie – property is often passed down from generation to generation, being inherited by all the children in a family. And, every single one of them must agree to sell. Which often means embarking on a paper trail to establish if they are still alive, and if so, where in the world they are.

“Clean title” means you know who owns the house (hopefully not more than one or two people), that their names are on the deeds and the ownership is registered, the property has a building permit (a formality for those built before 1968) and is accurately entered on the Cadastral map.

You also need to check that the house is actually “legal”. Yes, you did read that right. We’d been in the house nearly eighteen months before we realised that this was actually a thing – and we spent a few nervous days waiting for the officials to come out and deem whether the house was legal or not. Thankfully, it IS legal! And we now know that it is – ALL properties built before 1968 are deemed as legal by the powers that be, because in that year, there was an amnesty relating to all illegal buildings. The authorities photographed the country from the air, so if a building existed, there is a document to prove it. We have that necessary documentation.

It is also a requirement, if you are in Croatia for any length of time, to present yourself to the local police station. We were required to do this and have a short, informal interview where it was established why we were here, what kind of a property we lived in (and how many people lived there) and that we had the means to support ourselves. Not at all onerous and it meant that once we had registered with the police, we could proceed with our residency application. Again, a simple process but ensuring our residency status for five years – and which can be just renewed.

Utilities

Electricity

Electricity is currently supplied by the national company HEP (Hrvatska Elektroprivreda), so unlike in the UK, there isn’t a choice of suppliers. Once you’ve located your nearest HEP office, and have transferred the electricity account into your name, it’s then largely the same as in the UK. We receive our bills in the post and pay by direct debit – this is adjusted every six months, based on our consumption. One thing to be aware of is that domestic residences are often on the lowest “package” of electricity. We increased ours, by going back to HEP and upping our package, because we were finding that the supply tripped too often. We pay less per month for our electricity than we did in the UK, even though everything we have is electric, as we do not have a gas supply.

Gas

We do not have a gas supply to the property – this should be something you check if you prefer gas to electricity. However, we could have gas – it would just have to be delivered and stored in a cannister. We have chosen not to do this and so far, we have encountered no issues.

Water

Water is the same as in the UK. Your meter will be read by Vodovod and you’ll receive regular bills.

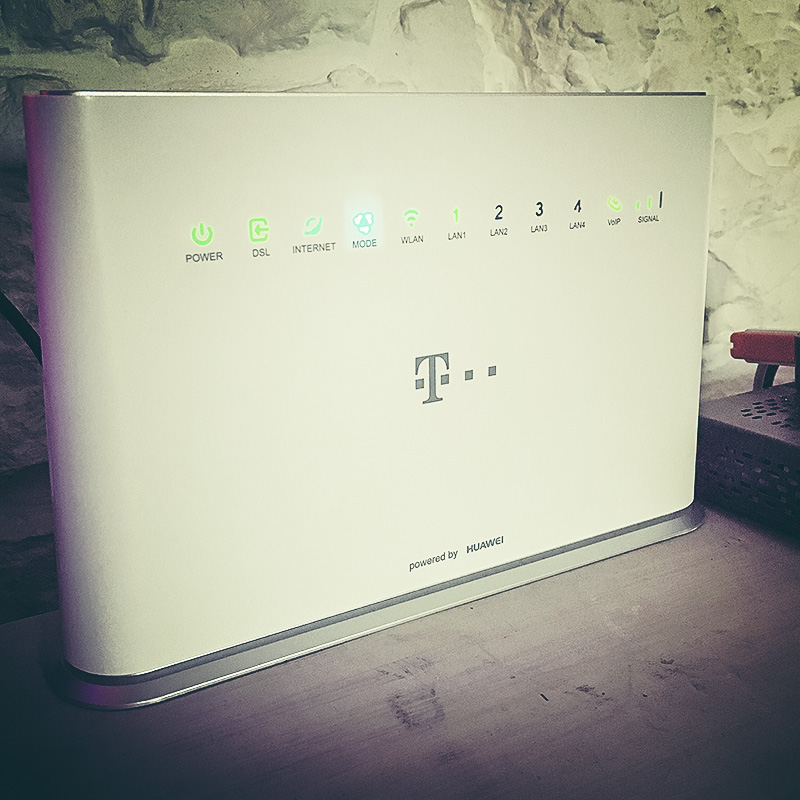

Internet etc.

As with electricity, the telecoms infrastructure in Croatia is largely provided by one company, T-Com. Although other providers are coming to the market, T-Com are the biggest and so far we’ve found them to be pretty acceptable. When we bought the house, there was no Internet connection and no phone line, so we relied on our UK roaming data in the early days. It was difficult initially arranging the Internet installation as there had never been a connection, and so we relied on a 4G router. This could be a perfectly good solution, but a router can be affected by weather and atmospheric conditions, so we persevered with our broadband quest and now have a stable, fixed line connection and everything is hunky dory, Internet-wise.

Mobile Phones

As well as our UK mobiles, we also have a Croatian mobile. Very handy for calling people in Croatia as the charges are much less.

Television

Now that we have broadband, we can access familiar television, whatever your preference is. Previous to this, we were reliant on a satellite dish and we could only receive Croatian, Italian and German TV channels. We now have everything we had back in the UK – we simply researched online and bought a TV Box, paying monthly for a very comprehensive package, which includes Strictly Come Dancing, Grand Designs and Premier League football – what more could you want?

Health Care

This is an IMPORTANT one, so if you are planning to make the move to Istria as permanent residents, do take our advice here, otherwise it could become costly. Health care insurance in Croatia is mandatory. You will be asked to show proof of your health care insurance when you apply for residency. Once you know where to go and what to do, it’s not complicated. We say this as people whose introduction to the world of HZZO was complicated, so you can have an easier experience if you follow our advice.

Start your application when you are doing the other bureaucratic things such a utilities, banking etc. Get it all done at the same time. The nearest HZZO office (hzzo.hr/en) is located in Umag. You do not need to make an appointment. You will need to show that you no longer have health care in the UK (or from whichever country you have been residing). We had to de-register from our UK GP practice in order to be entered onto the Croatian system. It’s then just a form-filling exercise and we got our Obavezno Health Insurance cards within a couple of weeks. This is the basic level of health care. We would recommend that the next level of health care – Dopunsko – is also taken out, as you will have more cover. The Obavezno monthly payment is made direct to HZZO. Dopunsko is like any other insurance – you can shop around to find the best provider. We have this cover via our bank. There is a third level of cover – Dodatno – which is a private policy. Further detailed information can be found here – www.expatincroatia.com/state-health-insurance-cost/

Once you have your health care insurance, you can then register with a GP.

Transport and Associated Infrastructure in Istria

Istria is a well connected peninsula. It shares a border, to the north, with Slovenia and once across the border, it is only about 25kms to Trieste. To the east, the rest of Croatia and the northern islands can be easily reached. The Adriatic Highway follows the coast down to Split and Dubrovnik. Alternatively, there is an excellent motorway – the E71 which merges into the E65 – meaning that there are more airport options for flying into and out of. Car ferries are frequent to the islands and the most northerly island – and therefore the closest to Istria – Krk, can be reached by a road bridge from the mainland.

The main airport in Istria is Pula and is located in the south, 99kms from us, up in the north. That may seem a long way, but you’ll be thinking of UK roads. Think Croatian roads. No traffic jams, easy toll roads, all (even country roads) in good condition and well maintained. So, it’s a pleasure doing this journey, and can be achieved in under an hour.

You will definitely need a car if you are to live in Istria – or even stay, just for a short time. Car hire is as easy as anywhere, but we made the decision early on that we would have two cars, one being insured for visitors to drive. This has certainly made life much easier as it affords much more independence for people visiting – there is very little public transport in the northern part of Istria, so a car is essential.

Roads are safe as there is much, much less traffic than in mainland Europe, and cycling is a big thing here. However, it’s also quite hilly. So, our solution was to buy two electric bicycles – a great investment, both for us and our guests.

Italy is very accessible by road. We have driven to Venice in two hours, but if you want a more leisurely journey, ferries cross regularly from Pula, Porec, Rovinj and Umag.

Border Crossings

Currently, Croatia is still not a Schengen member – although it is hoped that the country will have approval to join in the near future. This means that you do still need to show your passport when entering and leaving Croatia.

There are a number of border crossings in northern Istria which take you into Slovenia, including a small border very close to our house – with restricted crossing times (6am – 10pm) as well as the 24 hour crossings at larger borders.

Taxis, although rare, can be booked from the closest towns of Buje and Umag.

Some Useful Distances

Distances and approx. times (based on journeys we have done by car). The house to…

Pula Airport: 99 kms 1hr 10mins

Trieste: 44 kms 45 mins

Rijeka: 63 kms 50 mins

Zadar: 350 kms 4 hrs

Zagreb: 220 kms 3 hrs

Split: 470 kms 5 hrs 10 mins

Dubrovnik: 665 kms 7 hrs 30 mins

Venice: 208 kms 2 hrs 20 mins

Ljubljana (left): 119 kms 1 hr 35 mins

Calais: 1490 kms 15 hrs*

London: 1665 kms 17 hrs*

Manchester: 2012 kms 21 hours*

*Trips back to the UK always include overnight stays en-route.

Banking and Money

The currency in Croatia is currently the Kuna – although, it is anticipated that the country will move to the Euro.

As in the rest of Europe, there are a range of high street banks in Croatia – Privredna Banka Zagreb (PBZ), Erste & Steiermärkische Bank, Addiko Bank, Hrvatska Poštanska Banka – to name a few. Obviously, we had absolutely no knowledge of the Croatian banking system and so took advice from our new friends who we bought the house from – and we bank with PBZ. There are no shortages of branches of banks, but our advice would be to initially open accounts in a larger town, preferably one that deals with tourists, so that you have a better chance of dealing with someone who can speak more languages other than Croatian. Invaluable in this instance as opening an account can be a pretty laborious process. We opened our accounts in a small bank, with someone who couldn’t speak English and we made the error – or what we thought was an error – of opening a Euro account, as we thought this would serve us well on our travels. However, we soon realised that utility bills etc. could only be paid easily from a Kuna account and so had to open a second bank account. But, it has actually proven to be very good having the two accounts as we now have no issues when making purchases in Italy or Slovenia, for example, and therefore don’t incur additional charges. We have also retained our UK accounts as we still have our website design business and all of our clients are from the UK and so pay in sterling.

Cash points are very accessible, even in the more remote areas.

It is worth knowing that a lot of restaurants prefer payments in cash, although if pressed, most will take cards. Tipping is still fairly unusual and you definitely can’t tip on a card, as the payment received must equate to the bill given to the customer. So, top tip – have plenty of cash on you.

Weather

The weather in Istria was one of the factors which influenced our decision to move. After years of rainy Manchester we felt we deserved a bit more guaranteed sunshine – and that’s exactly what you get. Istria experiences proper seasons.

Spring tends to arrive March/April, and the days definitely start to warm up. However, there is a reason that Istria is so lush and green for most of the year, and that’s because we can get some very heavy rainfall. April, like the UK and northern Europe, can be wet – but the difference here is, it rains and then the sun definitely comes back out. We also don’t have days and days of rain.

Summer in Istria is hot – much hotter than the UK. June, July and August are beautiful months – but you do need to be aware that with hot weather, we do also get our fair share of thunder and lightning. And these storms can be quite fierce. When we first arrived here, we were rather alarmed at how strong they could be – electricity often goes off BUT, we have since been advised that the electricity company (HEP) often switches it off during a heavy storm, and straight back on again, as soon it is safe to. So, we no longer worry when it goes off – we just make sure we have plenty of candles lit. We also take preventative measures ourselves and switch off the fixed line Internet (the 4G router is OK to leave on), just to be on the safe side. It’s all part of our routine now, and just makes life a whole lot easier.

Autumn arrives in mid October (we can still have very warm days in September and into October) and winter takes hold in late November. Winter days can be very bright and sunny – and often still not too cold – although, in our first winter here (February 2018) we did have heavy snowfall. Although to be fair, it was The Beast From the East and even Manchester suffered the same! Heavy snowfall here is dealt with efficiently – roads are cleared almost immediately and snow ploughs are out and about, even on quite remote roads.